Start Here

Welcome to Fairmatic! Here, we use your driver's phone to track and analyze their driving behaviour and give them a safety score. Using driver-specific scores and our machine-learning algorithms, Fairmatic manages the risk better and passes the savings on to you.

How It Works

Our product has two main components that depend on each other.

- The insurance policy.

- Driving data.

Driving data is gathered and analyzed according to the 3 insurance risk periods, described below. To successfully capture these insurance risk periods and utilize the insurance product, you must collect driving data, which you do by integrating the Fairmatic software development kit (SDK) into your app.

Tracking Regulatory Periods

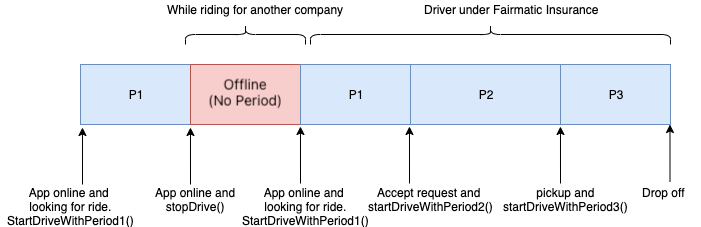

There are three Insurance Risk Periods, as defined by the California Public Utilities Commission:

- Period 1: The driver is logged into the mobile application, and is available for ride requests, but has not been matched with an occupant.

- Period 2: The driver has accepted a match but the driver’s vehicle is not yet occupied.

- Period 3: The driver has completed the pick-up and the driver’s vehicle is occupied.

For the rest of the document, the term "period" refers to these Insurance Risk Periods.

Marking the start and end of each period allows Fairmatic to accurately assess the risk of the fleet when providing quotes for commercial auto insurance. The diagram below shows how to set up the Fairmatic SDK appropriately so that each period is tracked correctly:

Keep in mind this is a general use case for a single rider. The periods and API calls that you’ll be using may not match this diagram specifically. Example: If you still have riders in the vehicle after you’ve dropped one off, you’ll still be in Period 3 which means there’s no need to change the period that you’re in.

Next Steps

To set up the Fairmatic SDK in your Android or iOS app, go to our Android or iOS Integration guides.

After integrating the SDK, make sure to follow through and implement insurance API calls and use the integration checklists to verify everything is set up correctly.

If you've already set up the Fairmatic SDK, you should validate that the SDK is capturing data correctly — our validation guide below can help you do that.